This article is a part of our series focused on helping newcomers to the world of Web3 understand the value of decentralized finance. Read on to explore crypto-enabled buy-now-pay-later solutions, and how businesses and users can benefit from cheaper, faster, and more inclusive credit systems.

The global financial landscape has changed dramatically in the post-pandemic era. The rise of the alternative “Buy Now Pay Later (BNPL)” credit system is a testament to this. In 2020, the BNPL market was valued at ±$87 billion. This grew to ±$180 billion in 2022 and is predicted to reach ±$3 trillion by 2030.

This growth is indicative of a shift in how consumers approach credit and purchases. Consumers are no longer bound by the traditional restrictions of credit systems. Instead, they have embraced the accessibility and convenience that BNPL services offer.

The growth of BNPL has coincided with the rise in popularity of cryptocurrencies and Decentralized Finance (DeFi). Demonstrating further how the general population is seeking alternatives to the traditional financial system.

As we continue to witness a shift towards digital and decentralized financial solutions, an innovative fusion of these two growing sectors – the BNPL model and cryptocurrencies – has begun to take shape.

In this article, we will explore how a “Crypto BNPL” system would function, the advantage it has over traditional credit systems, and how it can benefit consumers and businesses alike.

But first, if you want to learn about crypto-based lending solutions, read our in-depth report:

Download The Report on The Rise of Digital Lending in LATAMWhat is BNPL?

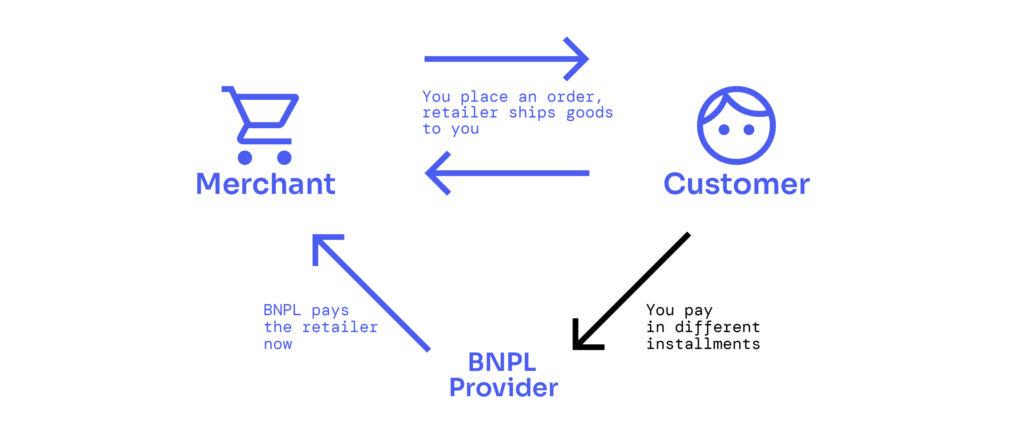

Buy-Now-Pay-Later (BNPL) is a type of short-term financing that allows consumers to purchase items and pay for them later, usually in installments. This kind of service has risen in popularity in recent years, offering a modern, simplified alternative to traditional credit schemes.

The essential premise of BNPL is convenience. It removes the barrier of immediate payment, allowing consumers to take home a product or use a service right away and split their payments into equal installments spread over a set period.

Consumers can quickly apply for BNPL services at the point of purchase (online or in-person). These services are approved without the time delays and stringent approval criteria associated with traditional loans.

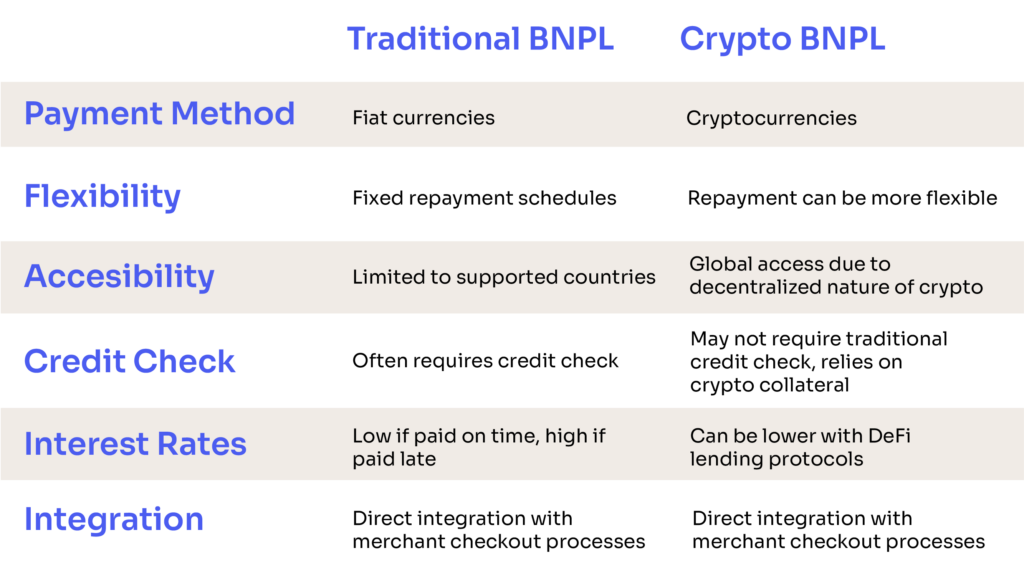

As the BNPL model grows in popularity, companies are beginning to explore how it can be integrated with crypto. These “Crypto BNPL” services aim to combine the convenience of traditional BNPL with the decentralization and flexibility of Cryptocurrency and DeFi.

How Does Crypto BNPL Work?

Crypto BNPL services blend conventional BNPL with the unique attributes of crypto. Various methods are employed to realize this — ranging from offering crypto as a payment method to the comprehensive incorporation of DeFi lending protocols at the core of the service:

Crypto as a Payment Option

The most straightforward way that BNPL services can incorporate crypto is by allowing users to make payments in cryptocurrency. This means integrating a crypto wallet into their offering so users can store their crypto directly within their BNPL app.

When a user makes a purchase and selects the BNPL option, they can pay the initial down payment and subsequent installments using their chosen cryptocurrency. The BNPL provider handles the conversion of crypto to fiat (for the merchant), allowing users to leverage their digital assets for everyday purchases.

Incorporating DeFi Lending

The next step for Crypto BNPL services is to integrate DeFi Lending protocols into their systems. This integration means that rather than paying for purchases out of pocket, users are effectively taking out micro-loans for the purchase amount.

These loans would be collateralized by the user’s crypto holdings and can be repaid over time. This method enables customers to leverage their crypto assets without needing to sell them outright.

Merchant Partnerships

The most important aspect for a crypto BNPL project to succeed comes from its ability to form partnerships with a wide range of retailers. These partnerships allow for seamless integration at the point of sale, whether online or in physical stores.

When a customer makes a purchase, they can choose the Crypto BNPL option at checkout, just like they would with a traditional credit card or PayPal. The merchant then receives payment in their preferred fiat currency, while the user’s payment is debited from their crypto wallet or paid over time via a DeFi loan.

Benefits of Crypto BNPL

Flexibility

Flexible currencies: BNPL accommodates both fiat and crypto payments, allowing consumers to make purchases with their preferred currency.

Flexible time: Traditional credit arrangements come with rigid deadlines—monthly payments are the norm. In contrast, Crypto BNPL using DeFi lending protocols allow users and merchants to determine the repayment schedule that suits their financial situation best.

Lower Costs

Crypto BNPL leverages crypto’s low transaction fees compared to traditional banking systems. This is achieved by eliminating the need for intermediaries, as transactions take place directly between the consumer and the merchant.

Minimal Credit Checks

Traditional BNPL services often necessitate thorough credit checks. In contrast, Crypto BNPL services can operate with minimal or no credit checks. This characteristic broadens the accessibility of these services, making them an appealing option for underbanked communities who may not have access to traditional banking or credit systems.

Financial Inclusion

Due to the decentralized nature of blockchain, cryptocurrency is inherently borderless. Consequently, Crypto BNPL brings vital financial services to underbanked or unbanked populations worldwide, fostering global financial inclusion.

Challenges and Risks of Crypto BNPL

As with any innovation, Crypto BNPL is not devoid of challenges and risks. Two primary concerns are the volatility of the crypto market and the regulatory uncertainty around BNPL.

Volatility

The volatility of cryptocurrencies can drastically affect the value of collateral for BNPL services integrating DeFi Lending. This can introduce a degree of uncertainty and risk for both the lender and the borrower. However, through the use of stablecoins, this volatility risk can be mitigated.

Regulatory Landscape

BNPL is a relatively new financial model and is still finding its regulatory footing around the globe. Some countries have started scrutinizing these services due to consumer protection concerns and are considering whether stricter regulations are necessary. While these discussions primarily focus on traditional BNPL services, they are likely to impact Crypto BNPL as well.

The cross-border nature of Crypto BNPL also introduces additional regulatory complexity. Providers must navigate varying regulations across different countries, considering different consumer protection laws and financial regulations. The evolving nature of these regulations could introduce unpredictability to Crypto BNPL operations.

What next? Explore The RIF Lending Report

Ready to dive deeper into the world of Crypto BNPL? The RIF Lending Report offers insights and analysis on how to utilize DeFi to shape the future of finance.

Whether you’re an established corporation, an emerging startup, or someone just starting their crypto journey, the RIF Lending Report is an invaluable guide. It cuts through the noise and provides actionable insights that will help you navigate this exciting space with confidence.

Download The Report on The Rise of Digital Lending in LATAMRecommended Reading

- If you are in search of the right crypto wallet for you or your business, read our comprehensive guide to choosing a crypto wallet.

- If you are interested in exploring financial initiatives that enable everyday convenience and promote financial inclusion, read our article on Regenerative Finance (ReFi) and how it promotes sustainability, inclusivity, and transparency.